Are opportunities finally equal for Australian owned businesses?

- Written by NewsServices.com

Whilst women have struggled for their right to equal pay, what often goes under the radar is the differences in business ownership between men and women. Of course, owning a business can mean dictating one's own pay, but getting there faces its own unique challenges to women.

The Bureau of Statistics reports that women made up just over a third of all business operators. Business operators are defined as an owner-manager of a company. That is, a business owner who works within their own company - with or without the help of staff.

In the 20 years from 1994 to 2014, the number of female business owners went from 459,100 to 668,670 - nearly a 50% increase, compared to only a 27% increase for men (1,018,400 to 1,294,400). Certainly, a rebalancing is occurring.

Female business operators in Australia are slightly under the median from developed nations, but the difference between male and female-owned operator numbers is smaller than in many countries too. For example, Turkey and Italy both have significantly more female business operators as a percentage of the employed population - however, their inequality is far larger.

In Australia, age 40 to 55 is by far the most common age range for business operators, suggesting that females begin setting up their business after significant career experience. Interestingly, female business operators were less likely than their male counterparts to live in the least disadvantaged socioeconomic areas, whilst male business owners are more likely to reside in disadvantaged areas.

This indicates that business ownership tends to be more accessible for middle-class females, whilst men see it as a means for social mobility. Regardless, female business operators were reported to be significantly more pleased in their life satisfaction ratings than both male operators and female employees. This isn’t an inherent difference between men and women, because male employees are slightly more satisfied than female employees - yet female business owners are significantly the more satisfied group.

Again, this tends to indicate that business ownership is more of a middle-class phenomenon for women, and not a means to escape poverty. The report also suggests that married, employed women are most likely to become business operators - three times more likely than single women, and were most likely to live in a couple where both partners work.

COVID Challenges

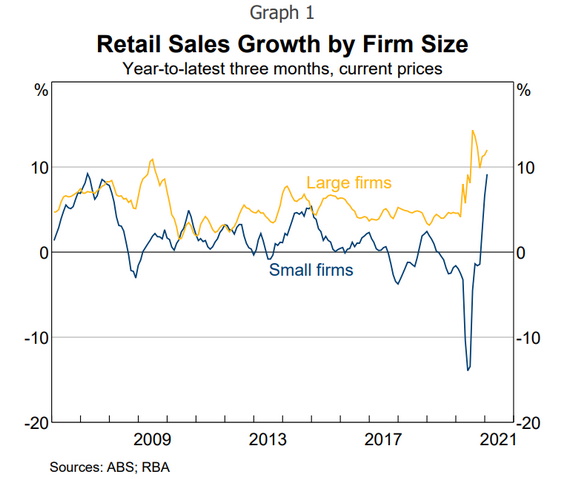

Covid-19 has brought about a lot of challenges for women in business. Whilst the virus itself was a big challenge, the lockdowns in response were the true economic killer. It’s easy to generalise the effects of the pandemic on all businesses, but we can see from the Reserve Bank of Australia’s graph below that small firms were hit the hardest.

Retail sales actually exploded during the pandemic for larger firms, whilst smaller firms felt a near 15% drop in demand. We can put this down to a few reasons. Firstly, larger firms tend to be the supermarkets and other essential stores that escaped lockdown. Secondly, they held more power, than say a female-owned sole proprietor, in lobbying to remain open.

Towards the end of 2020, it was predicted that 160,000 Australian SMEs - out of the 2,000,000 that exist - could be wiped out by the coronavirus pandemic. Whilst this number hasn’t yet been realised, the pandemic and subsequent lockdowns are far from over.

Unemployment skyrocketed during lockdown but has since fallen to 4.9%. However, underemployment remains up, meaning that there is certainly less demand and money circulating the economy. 2020 GDP was in negative growth, and whilst 2021 is likely to return positive growth, it’s unlikely to return to quite the same level as pre-pandemic.

The Australian economy was already struggling prior to the pandemic, so lockdown measures were a multiplier effect in how damaging the effects were. Fortunately, the Australian government had prepared and executed a very impressive amount of stimulus to instantly counter some of the crisis.

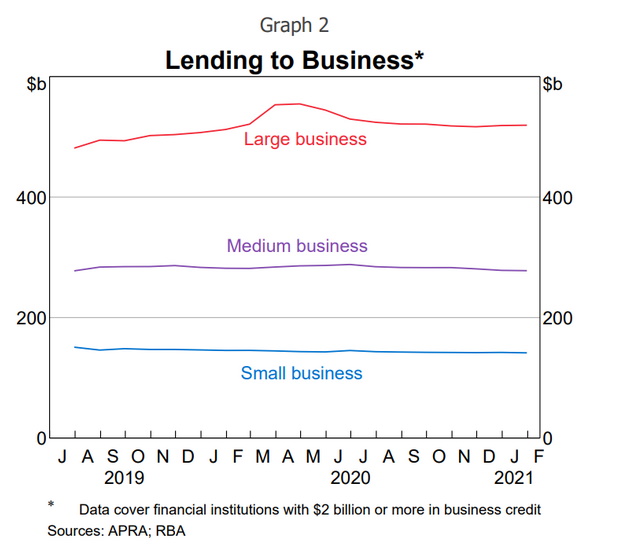

As we can see, lending to small businesses has been relatively unaffected in the past couple of years, whilst large businesses saw a significant increase in credit. This is more concerning than it appears when factoring in the previous graph - that small businesses have been more in need of credit than larger firms, given their fall in sales has been larger.

This comes down to a few reasons. There is certainly a reluctance in both men and women to attain more debt in a weaker and more uncertain environment - particularly for women as they already ask for less lending than men. Given that women are often given smaller, and more expensive loans, than men, it’s also possible that female business operators have relied more on government support, seeing as it’s cheaper than private financing.

Of course, it’s not just the business owner's decision either. Banks have certainly been more apprehensive about loaning small firms money in the current environment. Banks don’t like unpredictability at the best of times, which is why they rarely get along with small firms as well as larger ones. Lending has been tightened, meaning the option for cheap debt has been taken away. For example, more verification of borrowers’ information is now required, states the RBA, and banks are more averse to lending to the industries that are hit hardest by the pandemic.

Financing challenges

The verdict is still out on whether it was more difficult for females to stay afloat during the pandemic. What we do know is that single male Australian households hold four times as much business debt as single female households, and men have around 3 times as much business debt as a percentage of assets/debt.

This indicates that men have a greater appetite for debt, but it also goes hand-in-hand with American data that females find it harder to be approved for debt.

Businesses with bad credit struggle for financing at the best of times, let alone during a pandemic. Given that banks have very stringent credit criteria, many small firms have turned to small business loans online. This is certainly an option many female business owners take seriously too, as the automaticity of the process is thought to - hopefully - remove the potential for cognitive bias and sexism that can arise from the human interpretative aspect of bank loan meetings.

Online business lenders can be seen as advantageous in other areas, such as speed and likelihood of approval. Knowing you’re 95% likely to be approved within a day or so, and funds to be received within a couple of days, can be a massive relief for female SME owners. This access to funds act as an emergency fund; quick access to money in order to solve cash flow problems.

The minimum requirement of credit for many online lenders is around a 500 credit score - which is considered bad credit by banks. Of course, the resulting interest rates are higher, but if assets are used as security the interest payments can be reduced to a reasonable amount. However, this all depends on each situation - it may not be worth the high interest in a scenario of long-term growth projects, but it may be worth it if it’s the difference between survival and not.

Australian government support for businesses is drying up, and many firms have started to look elsewhere. Whilst banks are great for firms with a near-perfect credit score and great financials, others will have to turn to alternative forms of lending. Business lending among small firms has remained steady throughout the pandemic, but this was during the months of heavy governmental support.

Today, it’s looking likely that lending should rise. Given that the credit supply isn’t exactly full-flowing, we may just see a rise in higher-cost loans, whilst low-cost loans remain at their low constant levels. For women in business, this means taking risks and growing an appetite for debt and risk - one that has seemingly been absent in the past.

Alternatively, it may be a matter of changing businesses. Startups have shown resilience and many new businesses have been born out of the pandemic.